Fast-tracking Saudi Arabia’s economic diversification, from aviation to logistics

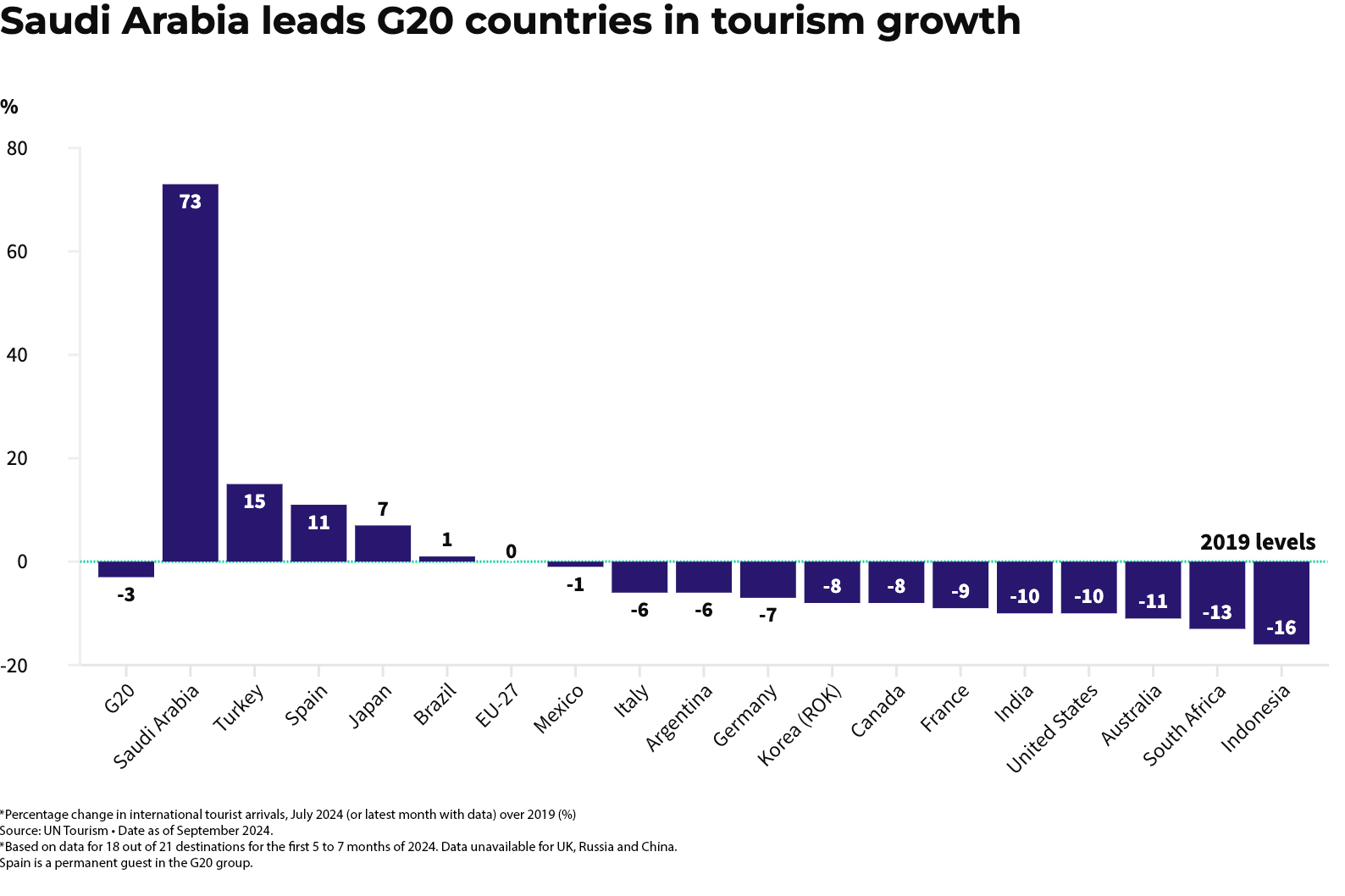

Saudi Arabia’s monthly arrivals by air were 73% higher in July 2024 than at the same point in 2019, marking the country’s emergence as a global travel hub. The opening of giant tourist draws such as The Red Sea destination has boosted Saudi Arabia’s visitor numbers, but it also reflects the country’s commitment to diversifying the economy away from oil.

By 2030, tourism is expected to account for 10% of national GDP, with PIF – one of the world’s largest sovereign wealth funds – developing significant infrastructure projects to support this aim.

“If you want to diversify the economy and invest in other sectors, aviation – and logistics as a whole – becomes the backbone,” says Muhammad Ovais Yousuf, Head of Aviation and Security Sector, MENA Investments Division, PIF. “So we developed PIF’s aviation investment strategy to support these wider economic and social goals, while also delivering returns.”

A new global gateway for Saudi Arabia

This strategy starts on the ground, with the development of new airports and other logistics hubs. One of the largest of these is the PIF-backed King Salman International Airport, a six-runway aerotropolis that will incorporate the existing terminals at Riyadh’s international airport. It aims to serve up to 120 million travelers per year by 2030 and 185 million by 2050.

Many of these arrivals will be visiting Saudi Arabia for business or pleasure, but a significant number will be in transit between the East and the West. To meet the growing demand, in 2023 PIF launched Riyadh Air, with a mandate to connect the country to 100 international destinations by 2030; it is due to begin flights this year. The new national carrier will leverage Saudi Arabia’s geographic location between Asia, Africa and Europe, enabling Riyadh to become a gateway to the world.

“Riyadh Air already has solid partnerships with Delta Air Lines, Singapore Airlines, Air China and other foreign carriers,” says Yousuf. PIF has also invested in Saudia Technic, the key player in Saudi Arabia’s aviation maintenance, repair and overhaul (MRO) industry. “To maintain our passenger volume growth, we need to transition from plain base maintenance to a high-value industry,” says Yousuf.

PIF is committed to tackling some of the industry’s biggest challenges. Perhaps the greatest of these is sustainability, with International Air Transport Association (IATA) member airlines committed to delivering net-zero CO2 emissions in air transportation by 2050.

In October 2024, Riyadh Air and Saudi-based energy company Saudi Aramco signed a memorandum of understanding for potential collaboration in areas such as low-carbon fuel supply and sustainability.

Muhammad Ovais Yousuf, Head of Aviation and Security Sector, PIF MENA Investments Division, says: “We would like to become self-sustaining in terms of alternative fuel.”

Lowering aviation’s carbon footprint is also critical to Saudi Arabia’s plans to become a hub for global trade. Projections by IATA suggest that the world’s freighter fleet will grow by up to 70% as the demand for cross-border e-commerce increases. To support this, King Salman International Airport aims to have capacity to process 3.5 million tons of cargo by 2050.

PIF is also investing in AviLease, a full-service commercial aircraft lessor established in 2022. Wholly-owned by PIF, AviLease is expanding its fleet of new-generation aircraft. One of AviLease’s partners is Air India Express, which has agreed to lease six Boeing 737-8s (one of the most fuel-efficient aircraft) from AviLease as part of its fleet modernization program.

Together, Saudi Arabia’s aviation infrastructure and its progress towards low-carbon fuel are creating a solid foundation to achieve a circular economy. There is a national target for tourism to create 1.6 million job opportunities by 2030, and wage growth is boosting demand for travel. There is already enough domestic demand for Saudi Arabia’s aviation growth to be self-sustaining, says Yousuf, pointing out that the number of domestic tourists reached 81.9 million in 2023.

A different model for national airlines

Tech transformation is key to this booming tourism market. As a digital-first airline, Riyadh Air is employing the latest technology – from flight bookings to on-board entertainment – unencumbered by legacy systems. “Even among the most profitable airlines, the biggest pain point is that their digital infrastructure is dependent on two core suppliers,” Yousuf explains. “But by building an airline from scratch, we’re hopeful we’ll be able to disrupt that and turn our digital infrastructure into a competitive advantage over legacy carriers.”

Integrating AI and digital technology into the flight experience gives passengers more control over their journeys, allowing them to organize onward travel or accommodation based on up-to-date flight information. This will not only benefit Riyadh Air’s reputation, but more importantly, it will ensure the levels of efficiency needed to turn Riyadh into a global business hub.

“Our goal is to offer a level of service, innovation and passenger experience that attracts travelers from all corners of the globe,” says Tony Douglas, CEO, Riyadh Air.

Tony Douglas, CEO, Riyadh Air says: “Our data-driven route planning identifies underserved markets with high demand for travel to and from Riyadh and unmet travel needs, ensuring we connect the capital to key global business and tourism destinations.”

To improve this connectivity, PIF is also investing in corporate transport. The Helicopter Company, which has been operating since 2019, signed a deal in February 2024 for up to 120 Airbus helicopters to provide aerial mobility within Saudi Arabia. This fleet will also support the company’s wider operations, which include emergency medical services and even giving fans an aerial view of the F1 Grand Prix in Jeddah.

With Saudi Arabia due to host the World Expo 2030 and the 2034 FIFA World Cup, aviation links will be a critical and highly visible driver of the country’s transformed economy. “Commercial aviation creates secondary and tertiary economic gain,” says Douglas. “It has a multiplier effect.”

The number of people who want to be part of Saudi Arabia’s aviation boom has caught even Douglas by surprise. “Since the launch of riyadhair.com and our job application page 18 months ago, we’ve had 1.4 million applicants from 143 different nationalities,” he says. “This is just incredible. And the best I can offer as a rational explanation is because it’s Saudi Arabia. Riyadh Air is 100% owned by PIF, so that means it’s not ‘might happen, could happen, should happen’. It will happen.”

PIF’s ambition is that better connectivity will increase business and leisure travel in and out of Saudi Arabia, while the push towards cleaner air travel and logistics will boost demand for the country’s cargo operators, its MRO industry and its aviation leasing services. Bringing each of these elements together will set Saudi Arabia on a steeper growth path, helping to diversify the national economy and to set new standards for the aviation sector, locally and internationally.

Produced by EI Studios for PIF, this article originally appeared on Economist Impact on December 20, 2024

-

PIF News Network

06 October 2025 The PIF Effect: Setting blueprints for growth in Saudi Arabia and the world

-

-

-

PIF News Network

12 May 2025 Luxury meets sustainability in Saudi Arabia’s landmark wellness escapes -

.jpg?h=465&iar=0&w=930)

.jpg?h=465&iar=0&w=930)